M&A Advisor Tip

Avoid key-man risk

Business owners should ask themselves, if I became incapacitated, could my business run without me? If the answer is no, buyers will be concerned about the business’s ability to operate when you’re gone.

If you can’t get away for at least a week of vacation at a time… if you hold key customer relationships… if you’re solely responsible for an essential business function… buyers will see risk, and rightly so.

To get the most value in a sale, you need to build a business that can operate without you. Better yet, try to eliminate key-man risk throughout the organization so that business operations can continue no matter who gets sick or quits unexpectedly.

Market Pulse Survey - Quarter 3, 2021

Presented by IBBA & M&A Source

M&A Feature Article

Perks are a way for owners to be further compensated for their hard work. However, they can complicate valuing a business. When you go to sell your business, make sure you do one of two things: 1) reduce perks to drop money to the bottom line, or 2) maintain an excellent paper trail so you can clearly delineate which expenses are needed for operations and which are done for you as a tax write off.

Be aware that doing a job for “cash” – or perks that can’t be tracked and proven – can diminish the value of your business. When preparing your business for sale, your advisors will “normalize” your financials to account for these extras. When perks are adequately documented, we can usually get the majority of that value accepted.

While valuing a business is not a straight calculation, buyers will use SDE (seller’s discretionary earnings) or normalized EBITDA (earnings before interest, taxes, depreciation, and amortization) as a tool when arriving at their offer.

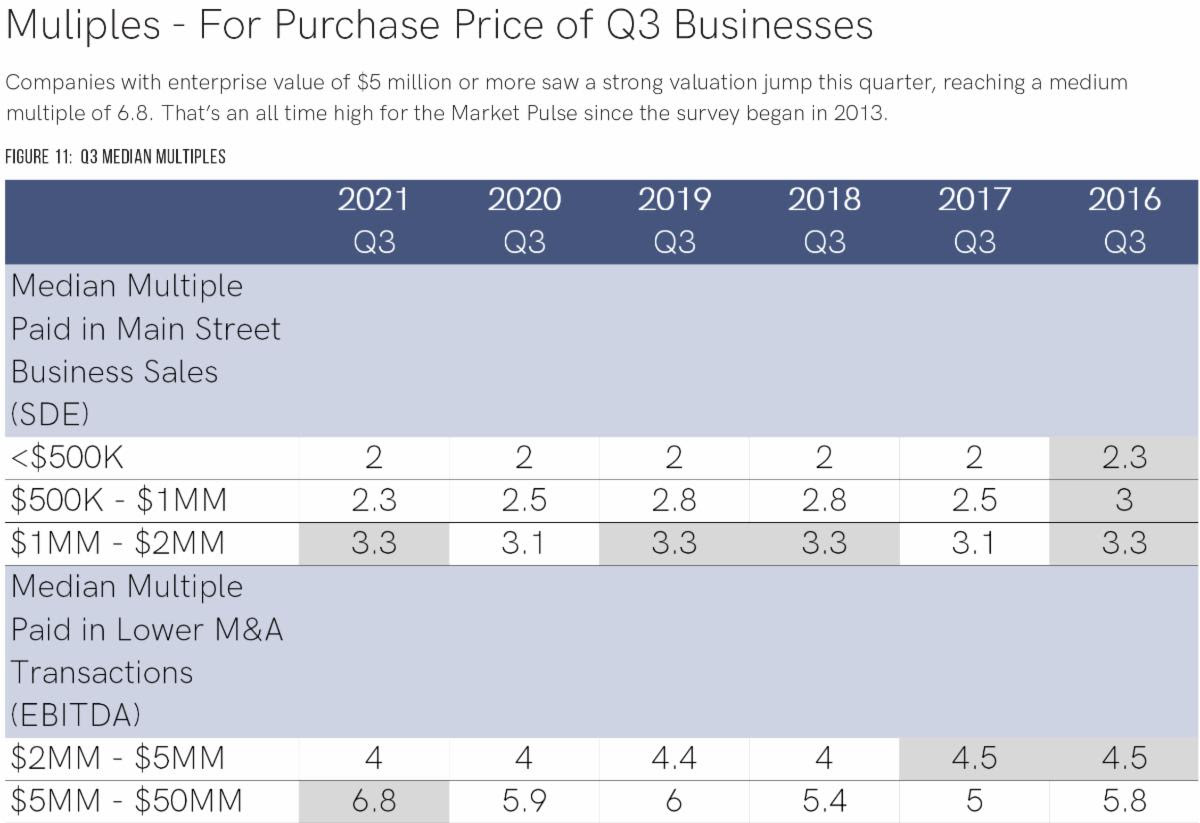

For example, a small Main Street business with an SDE of $200,000 USD will typically sell at a 2.0 multiple: $200,000 x 2.0 = $400,000 in value. A lower middle market business with EBITDA of $1.2 million might sell at a 5.0 multiple, or $6 million.

These are very general guidelines which can be influenced by any number of business factors or market conditions, but it helps to show the importance of driving cash to the bottom line in the last couple of years before you sell. Your discretionary cash is multiplied in a sale, so talk to your advisors about the tax benefits / value tradeoff of certain perks.

Think about how perks impact your total compensation and retirement needs, too. For example, if you’re pulling $200,000 as salary, you might think you can comfortably live off that amount in retirement income. But under closer examination, your perks may actually provide an income closer to $275,000. It’s important to know how much you’re truly taking out of the business.

Consider family perks as well. For example, maybe your child works for the company as part-time social media support but receives a salary equivalent to a fulltime marketing manager. Adjustments will need to be made there, too.

Perks are a common way for owners to pull additional value from their business. However, when it’s time to sell, your advisors need to be able to account for these perks in detail.