M&A Advisor Corner Tip

What's your growth story?

Where's your business headed? Buyers want a business with profit AND potential. Will your business still be relevant in 5 years? Where will growth come from?

If you don't have an expansion strategy at the ready, talk to an M&A advisor or an exit planner. We can uncover which parts of your business are most attractive to buyers. Then we can help you plan to increase value - whether that means operating the business on your own or taking on a buyer/partner who will help you take it to the next level.

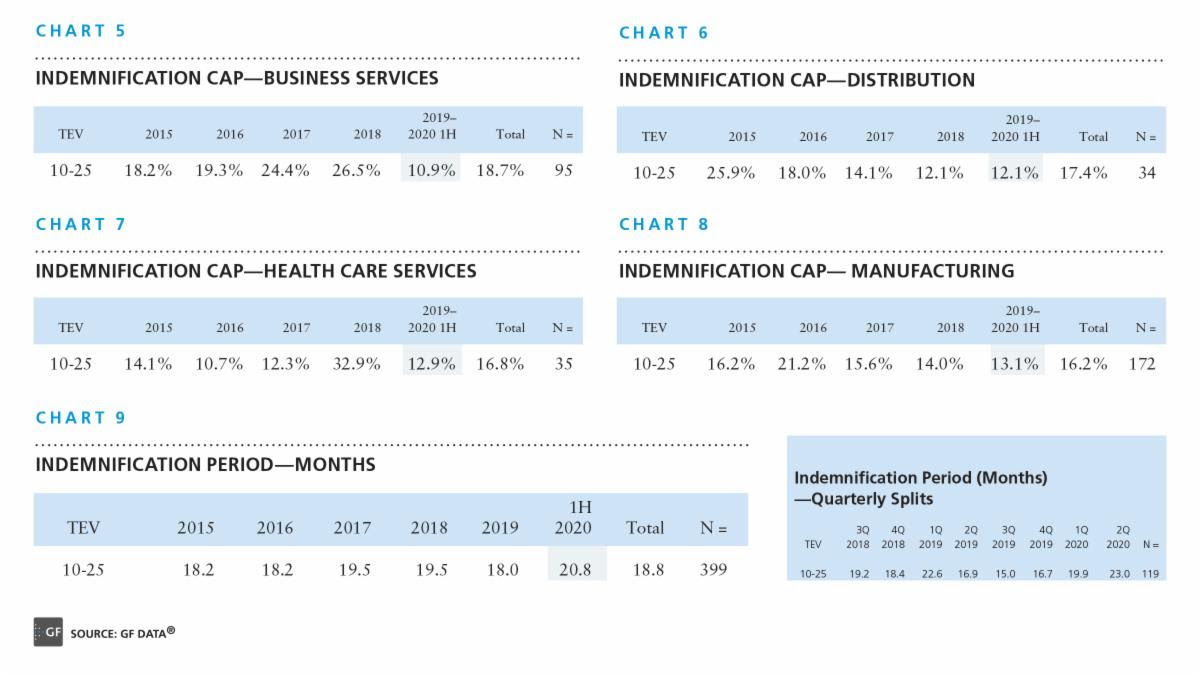

GF Data Report - Fall 2020