M&A Advisor Corner Tip

Work Yourself Out of a Job

The more your business revolves around you, the more risk buyers see. To increase business value, build a strong management team.

Work yourself out of the business by developing an experienced, empowered management team. The less the business is dependent on you and your knowledge or relationships, the less risk buyers face in a transition. And less risk translates to a higher sale price.

Market Pulse Survey - Quarter 2 2020

Presented by IBBA & M&A Source

M&A Feature Article

According to GF Data, companies with an enterprise value of $10 million to $25 million sold at an average multiple of 5.9 in the first two quarters, versus a 5.7 average from 2003 to present.

Similarly, business sales with a transaction value of $25 million to $50 million transacted with an average 6.8 multiple, which is again higher than the 6.4 average over the last 17 years.

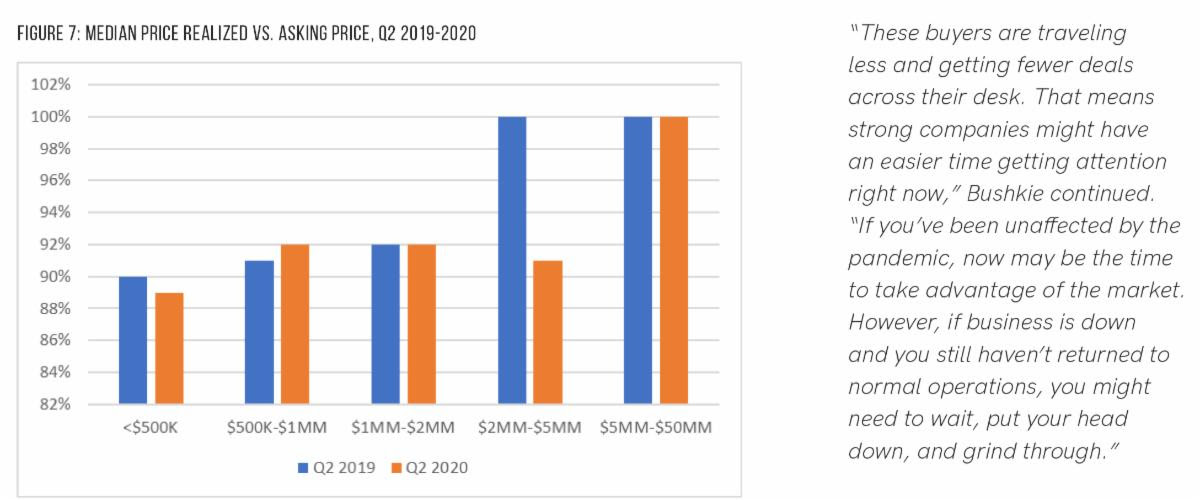

Deal volume is down, but values are not. The market has seen a significant pullback from sellers who are waiting out this period of uncertainty - assuming that now was not a good time to go to market.

We know that some buyers too, have put the pause button on acquisitions. But not all. Private equity, which is still sitting on an estimated $1.5 trillion of dry powder, has continued to push ahead in the current market. In conversations with firms across the country, they're telling us they are "absolutely open for business."

Meanwhile, strategic buyers (i.e., existing companies) are still at the table, although in fewer numbers. Corporations were in generally strong shape before the pandemic and still have the balance sheets to move ahead with acquisition strategies.

So what's driving such strong multiples, despite the downturn we'd expect to see in times of uncertainty? It's coming down to supply and demand. There are still active buyers in the marketplace, but it's sellers who are holding off.

We've had an imbalance in the marketplace for years, with more buyers than sellers with good, solid companies looking to exit. But now the imbalance is even more pronounced, and the number of buyers competing against each other has allowed values to stay strong through the first half of this year.

Based on conversations with industry peers, we do believe there will be a spike in the number of companies going to market in the third quarter. I have several colleagues taking companies to market after Labor Day. It seems sellers and advisors alike were waiting for summer to be over and the new normal to settle in.

It will be interesting to see if an uptick in sellers will have any effect on value multiples. What I can say is that it would take a significant increase in sellers to get even close to rebalancing the supply and demand equation. The market is lopsided right now, and sellers in the lower middle market still have leverage