M&A Advisor Tip

M&A breaking records

Inflation, employee shortages, conflict in the former USSR, COVID-19... In many years, any one or two of these dynamics could have put a damper on M&A activity. But today, M&A continues at a fevered pace. Last year, global M&A transactions totaled $5.8 trillion, 48% above record.

So what’s different today? We can point to two main drivers: Supply and demand and strong lending.

Supply and demand. We have more buyers looking for business acquisitions than we have sellers. Not only that, we have more money set aside for investment than we’ve ever seen before.

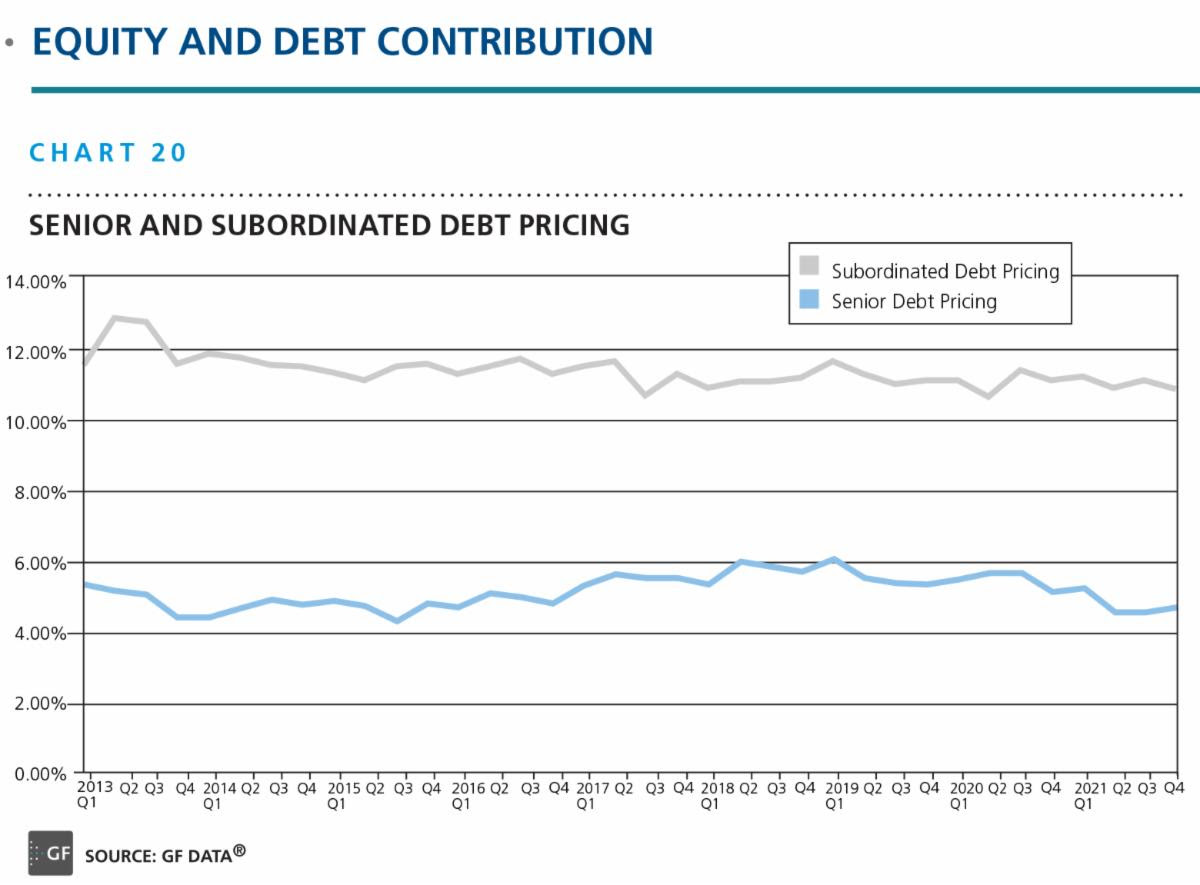

Strong lending. Fed hikes notwithstanding, interest rates are still the lowest we’ll likely see in our lifetimes. Money is cheap and available, and lenders are funding a larger portion of each transaction.

GF Data Leverage Report - February 2022

M&A Feature Article

Last year, after one of those residents passed away, their kids found the letter. They reached out to this couple and sold the house directly – likely below what it would have sold for on the open market.

If you want to buy a business in today’s market, this might be just the strategy you want to take. Identify your ideal targets, reach out, and plant a seed. It might pay off now, it might take years, but it’s a way to build opportunity for your business going forward.

Build-your-own deal flow. If you’re serious about acquisition, we strongly suggest targeting passive sellers. Just like passive job seekers, passive sellers are business owners who aren’t actively looking for a buyer. But when presented with the right opportunity, they might be willing to make a change.

Plenty of business owners are happy to go this route – bypassing the advisor fees and the entire marketing process – and to negotiate one-on-one with a “high-fit” buyer. Meanwhile, you have a better chance of winning the deal you want without paying sky high prices.

That kind of outreach takes time and resources. You may need to reach out seven, eight, nine times. Let the business owner know you’re serious, and you’ll stand out from all the other “fishing” letters they get.

Even if you don’t find someone interested in entering negotiations right now, you can start to build a relationship. Make sure you’re top of mind when they do decide to sell.

I can’t tell you the number of sellers who come to us with a file of letters and people they’ve spoken to throughout the years. They already know who they like and who they want to talk to again.

Plan and be ready. Build a deal team (internal or external) who will help you identify your ideal acquisition criteria. Don’t wait for something that “only kinda fits” to hit the open market. With the right plan and outreach, you can create better opportunities that align with your needs.

Here’s the thing: Many owners think about selling when things are not fun. And with Covid, supply chain, and recruiting issues, running a business is definitely challenging. It could be an ideal time to find a business owner willing to raise their hand and say, “Yeah, I’m interested.”