Advisor M&A Tip

The Discipline to Diversify

As a general rule, no one customer should account for more than 20-25% of your revenue. While having large customers can be good for your bottom line, it introduces risk to the next owner.

As you build your business, pay attention to what a future buyer will want. They're looking for well-diversified customer groups where the loss of one account won't have a devastating impact. Do the hard work of diversifying, and you'll increase your future business value.

Market Pulse Survey - 1st Quarter 2019

Presented by IBBA, M&A Source and in Partnership with Pepperdine University

Why Are Owners Selling?

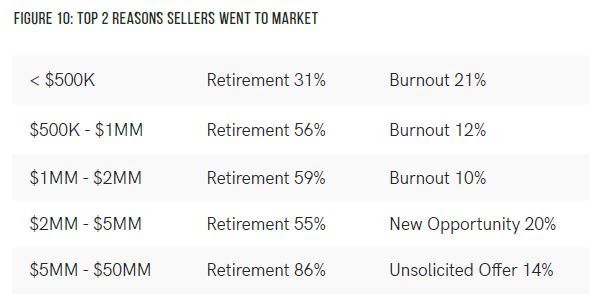

Retirement leads as the number one reason to sell across all sectors. In the Main Street market, burnout was the second leading trigger for sale. In the lower middle market, sellers also left for new opportunities or because they received an unsolicited offer

"Smaller business owners tend to wear more hats and carry a lot of stress and responsibilities on their shoulders. Unfortunately, those things lead to more than burnout; they can also lower your business value," said Warren Burkholder, president of NEVRG, Inc. "The more you can develop and empower your management team, and actually work yourself out of the business, the more it's typically worth to a buyer."

M&A Feature Article

But your M&A advisor is the quarterback, not the whole team. Your advisor is in charge of ensuring you have the right people around you, including the right attorney, to reach a successful close on your deal.

We've always recommended our clients work with an M&A attorney, legal counsel who specializes in business transitions. Lately, though, we're transitioning more from recommendation to insistence. In fact, we're adamant.

If you've done everything right to maximize the value for your business, and then we've done everything right to find a buyer that fits your goals, we don't want the deal to blow up because your long-time attorney muddied the operation.

It happens. We've had deals fall apart because the attorney didn't know what they didn't know, or because they got overly aggressive and outside the norms in protecting the seller's interests. And, on rare occasion, we believe there are even a few bad apples (like every industry) out there who will foil a deal simply because they don't want to lose your business.

We have this conversation a lot. Most sellers want to bring in the attorney they've used for years. Maybe this attorney helped you set up your entity, handled some collection issues, and reviewed your contracts. You know them. You trust them.

But this is no time to choose an attorney simply because you've worked with them before. That would be like trusting your general practitioner who does your annual physical with brain surgery. When it's a matter of life and death, when you only have one shot, you want the very best. You want the specialist who does nothing but brain surgery all day, every day.

And that's what you want when it's time to sell your business, too. You typically get one chance to sell your life's work. That is not the time to be loyal and help your friend learn on the job.

Be wary of the general business attorney who tells you, "I can do that too." Because 99 times out of 100, they're biting off more than they can chew.

Based on our experience, I'd estimate only 1 percent of the active lawyers in any state are truly M&A specialists who regularly negotiate transactions. Even fewer will be the right fit for your business, with experience representing businesses of your enterprise value and particular complexities.

So, make sure your M&A advisor is vetting all the professionals involved in your sale. You want that dream team who will get you across the finish line. Your trusted attorney can and should be part of the team, too, as long as you don't put a generalist out in front.